HMRC report shows Corby as UK hotspot for tax avoidance schemes

and live on Freeview channel 276

Corby has emerged as one of the UK’s hotspots for tax avoidance schemes, a new report has shown.

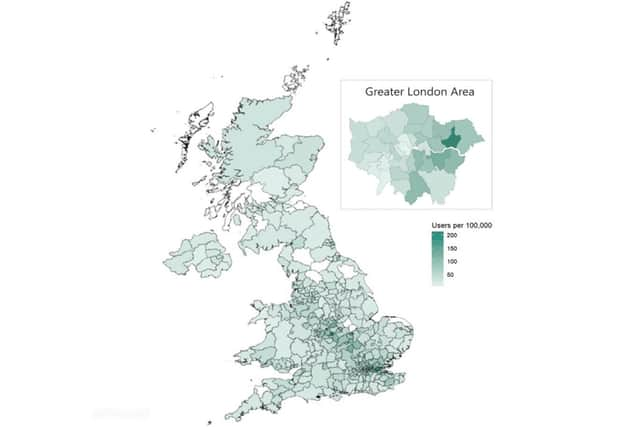

HMRC’s latest marketed tax avoidance research report shows that for 2020-2021, Corby recorded more users of marketed tax avoidance than almost any other area.

Advertisement

Hide AdAdvertisement

Hide AdThe report finds that for every 100,000 cases, there were 126 to 150 cases of people using tax avoidance schemes in Corby, one of the highest of any local authority across the UK, on par with Dartford, and Greenwich, and only beaten by Tamworth (201 to 225 cases) as well as Barking and Dagenham, Nuneaton and Bedworth, and Thurrock, all three of which had 176 to 200.

Locally, Wellingborough had 76 to 100 cases while Kettering had 50 to 75.

Marketed tax avoidance schemes are contrived schemes that are sold by promoters to one or more individuals and employers for a fee, with the aim of reducing their tax liabilities.

Mary Aiston, HMRC’s director of counter-avoidance, said: “These schemes are cynically marketed as clever ways to pay less tax. The truth is they rarely work in the way the promoters claim and it is the users that end up with big tax bills. HMRC will continue to use all the powers at our disposal to crack-down on promoters.

Advertisement

Hide AdAdvertisement

Hide Ad“Anyone who thinks they may be involved in a tax avoidance scheme, or has been approached by a scheme promoter, should contact us as soon as possible to get help."

The latest avoidance report found those working in hospitals to be most at risk, and that people aged between 41 and 50 were the highest users of tax avoidance schemes.

In 2020 to 2021, the estimated amount of tax the UK lost to marketed tax avoidance was around £400m.

HMRC continues to tackle all aspects of the tax avoidance market including regularly naming operators of tax avoidance schemes. Further information about published tax avoidance schemes and promoters can be found on GOV.UK.

Anyone who believes that they are involved in a tax avoidance scheme, should contact HMRC as quickly as possible by emailing [email protected]