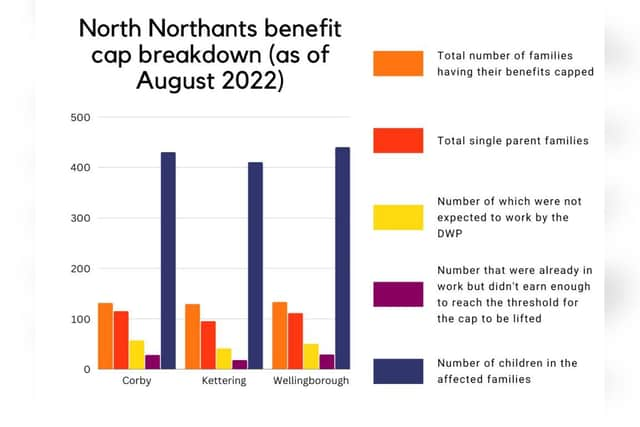

Families in Corby, Kettering, and Wellingborough are having their benefits capped despite being not expected to work

and live on Freeview channel 276

The Government capped the benefits received by 148 families in Corby, Kettering, and Wellingborough last year – despite telling them they were not expected to be looking for work.

Charity Child Poverty Action Group said the figures demonstrate the flaws in the Government's approach to capping benefits, which is designed to encourage more people into work.

Advertisement

Hide AdAdvertisement

Hide AdThe cap limits the Universal Credit of households who earn less than £658 a month. Claimants escape the cap if they can earn more.

Corby

Figures provided by the Department for Work and Pensions show there were 131 families having their benefits capped in the Corby constituency as of last August.

Of these, 57 of them were not expected to be in work by the DWP, either due to health problems or having caring duties – often for very young children.

Another 28 families were already in work, but didn't earn enough to reach the threshold for the cap to be lifted.

Advertisement

Hide AdAdvertisement

Hide Ad

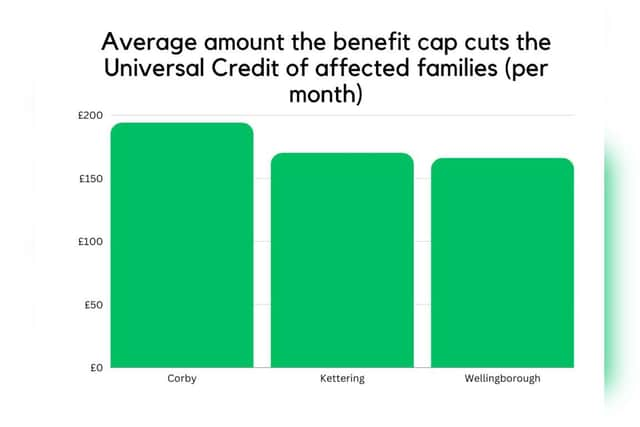

In Corby the benefit cap cuts the Universal Credit of affected families by an average of £194 a month.

The 131 families affected had 430 children, and included 115 single-parent families.

Kettering

There were 129 families having their benefits capped in the Kettering constituency.

Of these, 41 of them were not expected to be in work by the DWP.

Advertisement

Hide AdAdvertisement

Hide AdAnother 18 families were already in work, but didn't earn enough to reach the threshold for the cap to be lifted.

In Kettering the benefit cap cuts the Universal Credit of affected families by an average of £170 a month.

The 129 families affected had 410 children, and included 95 single-parent families.

Wellingborough

There were 133 families having their benefits capped in the Wellingborough constituency.

Advertisement

Hide AdAdvertisement

Hide AdOf these, 50 of them were not expected to be in work by the DWP.

Another 29 families were already in work, but didn't earn enough to reach the threshold for the cap to be lifted.

In Wellingborough the benefit cap cuts the Universal Credit of affected families by an average of £166 a month.

The 133 families affected had 440 children, and included 111 single-parent families.

Advertisement

Hide AdAdvertisement

Hide AdThe figures were provided to the Child Poverty Action Group through Freedom of Information requests, which found more than one in three families across England, Scotland and Wales in receipt of Universal Credit are having their benefits capped while not being expected to work – 37,970 in total.

The charity's chief executive Alison Garnham said the Universal Credit cap should be completely removed.

She said: "Our data demonstrates the fallacy that the benefit cap is a work incentive. How can it be when so many households caught by it are unable to take a job because of young children? It doesn’t incentivise work, it leaves children hungry.

"The Government’s position on the cap is incoherent. It must be removed before it harms more young lives."

Advertisement

Hide AdAdvertisement

Hide AdThe Government recently announced the benefit cap will be uprated in April by 10.1 per cent, in line with inflation. This will mean that capped households can gain from annual benefit uprating for the first time since the cap was implemented in 2013.

But the benefit cap has not increased since it was introduced in 2013 and, in 2016, it was lowered.

CPAG said after April’s uprating the benefit cap will still be £225 a month lower in real terms than it was in 2016 due to it being frozen in previous years.

A spokesman for the DWP said there were now 200,000 fewer children in absolute poverty after housing costs compared to 2019-2020, and that many of the most vulnerable were exempt from the benefit cap.

Advertisement

Hide AdAdvertisement

Hide AdThey added: “From next month the annual benefit cap for a single parent will be more than £25,000 in London and £22,000 elsewhere in Great Britain. It balances fairness for taxpayers with providing a vital safety net and is designed to provide a strong work incentive, by ensuring that work pays.

“Many of the most vulnerable claimants - including those who are in receipt of Universal Credit because of a disability or health condition that prevents them from working - are exempt from the cap.”